How to Value a Startup

Startup Investing 101

Valuing a startup is hard; and it’s probably as much an art as it is a science. It is difficult because early stage companies are at the very beginning of their life cycles.

How, exactly, does one value a company with little-to-no revenues, that promises to create the next Facebook?

Why Valuing a Startup is Important

This whole discussion is so crucial, as when a company raises money, it does so at a certain valuation — Company X raised $Y at $Z valuation.

If a company grows from scratch to be a $500m company, that’s great for early stage investors but what really matters is the valuation that the investors put their money in at.

In this example, there is a significant difference between putting money in at a $5m valuation against a $100m valuation.

First, Get the Lingo Down

Professionals talk about “pre-” and “post-” money valuations.

Pre-money is simply the value of the company at the start of the investment round – before any additional funds have been added.

Post-money is the value of the startup after the infusion of funds.

For example: Startup A is valued at $500,000 pre-money and receives an additional $500,000 of funding during the round — then the post-money valuation of Startup A is $1,000,000 ($500k + $500k).

But as an investor, how do you know what the right valuation is?

More specifically, how does one know if they are getting a good or bad deal?

The Five Stages for a Startup: From Funding to Exit

Before one can answer this question, it is important to understand the startup life cycle; because depending on where you enter as an investor, valuations can vary wildly.

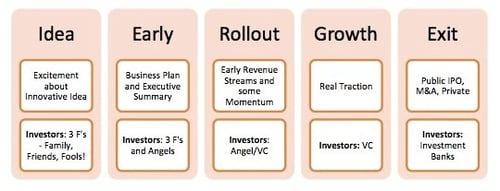

According to Martin Zwilling, the founder and CEO of Startup Professionals, startups pass through five stages en route to exiting (if they are able to make it that far).

The chart is a basic summary of his points:

How to value a startup

If you are looking to this post for guidance, you’re most likely to find investment opportunities in the first two or three stages, making you either a certified member of the highly coveted 3 F’s (friends, fools, family) club, or a new angel investor.

The question one now faces is: How does one value a good investment when it comes my way?

A friend mentions two investment opportunities: one is pre-revenue and the other has some traction. Both sound promising and you are hooked on investing in at least one of them.

What is the most practicable and effective way of valuing them?!

Conventional Pre-Revenue Best Practices

The views presented below are taken from highly successful Angels/VC Fund Managers/Academics who have spent the bulk of their working careers attempting to get a handle on valuations.

Comps (Comparables) method: Find a company that shares as many characteristics as possible with the one you are interested in and see what it sold for. A leader on this simple approach is Aswath Damordaran, professor at NYU and renowned valuation guru.

In a lengthy paper, he writes that “… it seems logical that we should look at what others have paid for similar businesses in the recent past. That is effectively the foundation on which private transaction multiples are based.”

While the other 60-some pages discuss how these numbers need to be tweaked for a variety of factors, there is no doubt that the right Comps are king in mainstream pre-revenue valuation.

Team method: This was also discussed in a previous post we wrote about how to identify a talented startup team. The main conclusion was that a strong management team, lacking any obvious weaknesses, is more important than seemingly awesome ideas on its own.

Rick Heitzman (managing director of Firstmark Capital – one of the early funds to invest in Pinterest) really put the importance of good management in perspective when he said in a Wall Street Journal interview:

“If Jeff Bezos (the founder of Amazon.com Inc.) decides he’s leaving Amazon to start a new company, it wouldn’t matter if he had no idea what the company was going to be.”

Minimal risk and appropriate reward method: This one is tricky because at the pre-revenue stage, it is extremely difficult for entrepreneurs to minimize risk as there are so many unknown variables. Investors generally approach this issue by performing “due diligence.”

WAIT! While research and forward looking estimates from experts are both great and valuable, at the end of the day, the results are premature because the company is not yet producing cash flows. Therefore, these numbers are just educated guesses, which does not make them illegitimate but they are still decisions made with the best available evidence.

There are many variables that can affect the research. To quickly list a few: The market size may be smaller than estimated, or a new competitor might seize a substantial portion of the market share. The competent and well-reputed management team may clash, or legal issues might slow down the time to market which in turn could cause the business to be cash strapped or run out of money. For a comprehensive list of “startup killers,” click here.

While everyone dreams of finding a risk-free investment with guaranteed reward, no such investment exists… especially when it comes to early-stage companies.

So, sure, there are risks, but how do you deal with them?

Putting Theory into Practice: Making a Formal Scorecard

Investors should only be interested in investment opportunities where as many risks as possible have been removed entirely, and those that remain are justifiably offset by tremendous opportunity – either in terms of more bang for their buck – a larger chunk of the pie — or better rights in future rounds.

If you were expecting a concrete guide to early stage valuation, this piece is, admittedly, very frustrating.

While you should be able to identify which factors are important when valuing a startup, the bottom-line is: you probably still can’t value one on your own.

The Scorecard Method is an Easy Evaluation Anyone can do

4 steps to Scorecarding:

Assign each factor (a sample list is provided below) a score/weight that is appropriate for an average startup

Go through each factor and determine where the startup ranks, (is it better or worse than average and by how much?)

Sum the total factor (promising startups total factor will be > 1, average ones = 1, and less-than -average ones will be <1)

Multiply the total factor by the average valuation of comparable companies

Assigning weights to the score could look something like this:

Management Team – 30%

Opportunity Size – 25%

Product/Technology – 15%

Competitive Environment – 10%

Marketing/Sales/Partnerships – 10%

Need for additional Investment – 5%

Other Factors – 5%

Although this method is far from a hard science, and the average weights provided are just one potential view, at least it provides a ballpark valuation and a starting point.

Here is the basic proposed strategy up to the point: Consider relevant comparables, delve into their management team, and consider the level of perceived risk. If all these factors are positive, it probably will have a higher valuation.

Lastly, there are many professionals who assess that to focus primarily on pre-money valuation is negligent.

Al Schneider, Co-Founder of Pasadena Angels is among those who are vocal about this. He claims that "pre-money valuation is just one of many funding terms and conditions important to investors and companies, and not necessarily the most important one.”

For these investors, haggling over a valuation not only delays an investment, but, more importantly, it means that the investor missed the point. These contrarians argue that angel investments have two diametrically opposed outcomes: either you hit it big or it’s a big goose-egg (0). The old swing for the fences concept: Home-runs more than offset the strikeouts.

Ultimately, valuing a start-up is not an easy process and there is no uniform method – a sort of one size fits all. However, one thing is for sure: as an investor it is important to delve deeper into the many elements of the startup to get a real grasp of its value.