We frequently get asked about our investment methodology. Our investment process has been honed by the decades of investing experience our senior management has.

One interesting note: Our founder and CEO, Jon Medved, managed a startup portfolio of almost $300M. The rest of OurCrowd’s management team has serious chops, too. We’ve all got experience building and running our own companies, management consulting, equity research, investment banking, and portfolio management.

Remember, although OurCrowd members can choose to invest in as many of the companies we list for investment, OurCrowd invests its own capital in every deal we show to investors. We’re ponying our own money up alongside the crowd.

So, what do we look for in a startup investment?

OurCrowd’s 5 Point Investment Checklist

- Great team: Successful startups are founded by great people. So, when we look at potential investments, we give serial entrepreneurs special attention. We’re looking for people who have built and managed companies. Failures are OK, too. It’s the process of realizing an idea, building out a plan that we’re looking for. Great people are essential.

- Market: The startup must address huge market growing like a weed. We’re not looking at arcane ideas addresses small, niche markets. We want to see that the market is huge and it’s already growing – it doesn’t require an educational sale to get moving.

- Easy to understand: We look for investments with a simple value proposition, easily understood by “our crowd.” I want to be able to tell my 12 year old kid what the company does and have them easily comprehend. People should be able to explain it to one another easily.

- Traction: We do invest in early stage companies, but we’re not talking about ideas looking for some capital to begin building them. We want to see that an early version of the product or service has already gotten significant traction. Traction can come in many forms: users, partners, revenues—but not an idea pre-prototype

- Sponsorship: Investing in startups/building out early stage companies is a team sport. Board members, advisors, strategic partners or angels… having the right team is super important. It doesn’t have to be set in stone, but we look for some kind of group already forming around the startup.

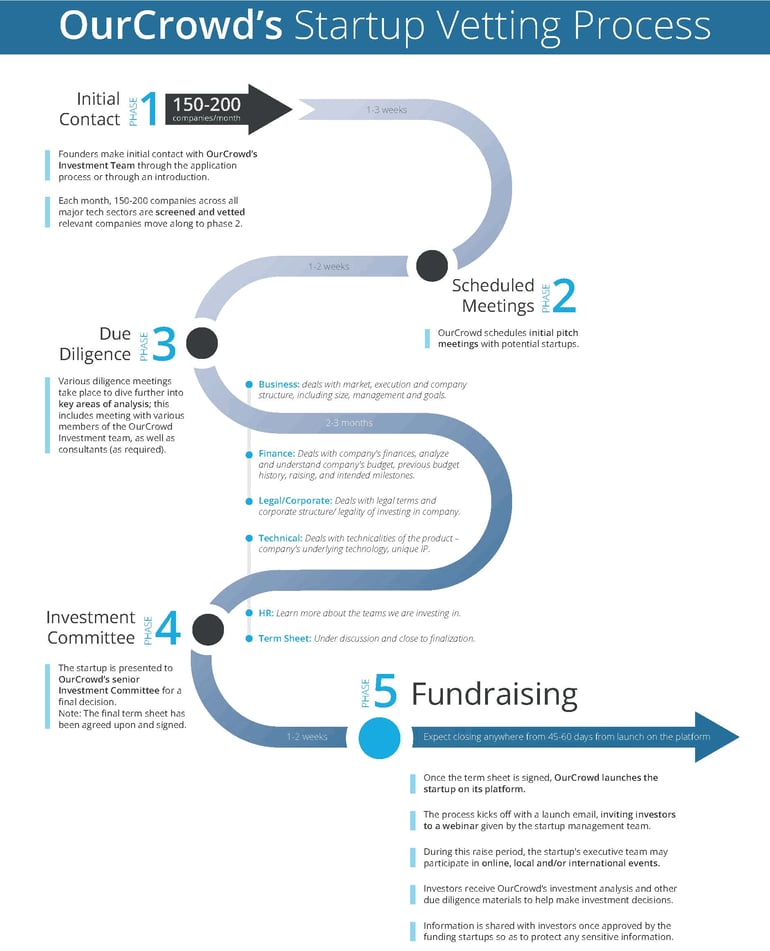

OurCrowd’s Startup Vetting Process

OurCrowd's team of investment professionals has vetted more than 8,500 startups from around the world since 2013. Each month, the team selects a number to screen further from 150-200 companies, and the Investment Committee passes around 2% for investment by OurCrowd and its community.

Below, get a detailed view of the startup vetting process.

Next Step: