Increase Diversification & Defer Taxes

As all investors know, diversification of investments is essential in any portfolio and serves two primary purposes, mitigating risk and maximizing returns. Simply put, don’t put all your eggs in one basket. There is more to investment diversification than mutual funds, stocks and bonds. Investing in alternative assets via a self-directed IRA not only potentially adds more diversity to your portfolio, but it also provides tax-free growth over time.

Investment in alternatives have grown from $2.5 trillion in 2004 to $6.4 trillion in 2012, and is expected to exceed $13 trillion in 2020.[1] This increasing number of investors are incorporating alternatives into their retirement portfolios which may include one or a combination of the following alternative asset types:

Venture capital

Venture capital- Real estate

- Hedge funds

- Commodities

- Private equity investments

- Private corporate debt instruments

- Debenture offerings

- Real estate notes and trust deeds

- Gold and precious metals

- Crowdfunding

The case for diversification in venture capital

Venture capital is an increasingly important component of equity investing, given that early stage companies are waiting longer to go public. An influx of abundant capital into private companies has allowed many companies to delay their IPO until much later in their lifecycle – which significantly limits returns once they are public.

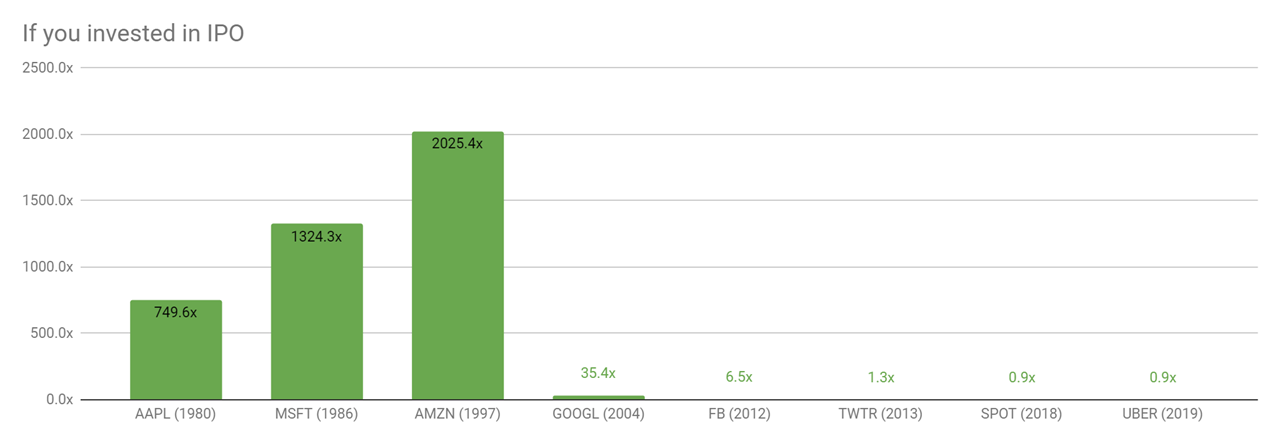

Investments made in tech giants Apple (1980), Microsoft (1986), Amazon (1997) and Google (2004) at their IPO price generated respective returns of 749x, 1324x, 2025x, and 35x at today’s prices (as of August 2019). Compare these astounding multiples with those of more recent tech unicorns Facebook (2012), Twitter (2013), Spotify (2018), and Uber (2019). These latter four companies generated significantly more modest returns 6.5x, 1.3x, 0.9x, and 0.9x respectively on the public markets, largely because they remained private longer, giving private investors who invested early.

The chart below further serves to highlight this contrast, and reinforces the point that the abundance of venture capital money has enabled companies to remain private longer, at increasingly higher valuations, which serve to benefit private investors at the expense of opportunities for investors in the public markets. The IPO valuations of Apple ($1.2B), Microsoft ($0.8B), Amazon ($0.4B) are dwarfed by those of Google ($23B), Facebook ($81.8B), Twitter ($24.5B), Spotify ($29.5B), and Uber ($75.5B).

-6.png?width=1280&name=image%20(1)-6.png)

Investing with a self-directed IRA

By investing in alternatives like venture capital, via a self-directed IRA, investors can access the full spectrum of the investment universe inside their own retirement account, and returns will be tax deferred. Additionally, alternatives have a low correlation with other asset classes (stocks and bonds among them) and may serve as a counterbalance during market volatility and can help offset any downside, and, when held in a tax-deferred IRA account, it can also provide opportunities for outsized tax-deferred growth.

Maintaining the right mix of traditional and alternative assets can reduce undue risk and help to lock in attractive total returns. For more information about what alternatives can be included in a self-directed IRAs, see IRS Publication 590A.

If you want to learn more about investing in private companies and how the numbers stack up, check out What Babe Ruth Could Teach About Maximizing Returns on Your Startup Investments.

Next Step: